The U.S. Energy Information Administration (EIA) has reported that natural gas was the #1 electricity generation source in the first half of 2020. When compared to the same time period for the previous year, 2019, natural gas was the fastest-growing source of electric power generation according to the EIA.

Although overall electricity generation saw a decline of 5% in the first six months of 2020—largely as a result of decreased business activity during the COVID-19 pandemic—natural gas generation increased as result of lower prices and natural gas-fired power capacity additions. In fact, natural gas generation from electric power plants hit a record high on July 28, as a result of peaking summertime heat.

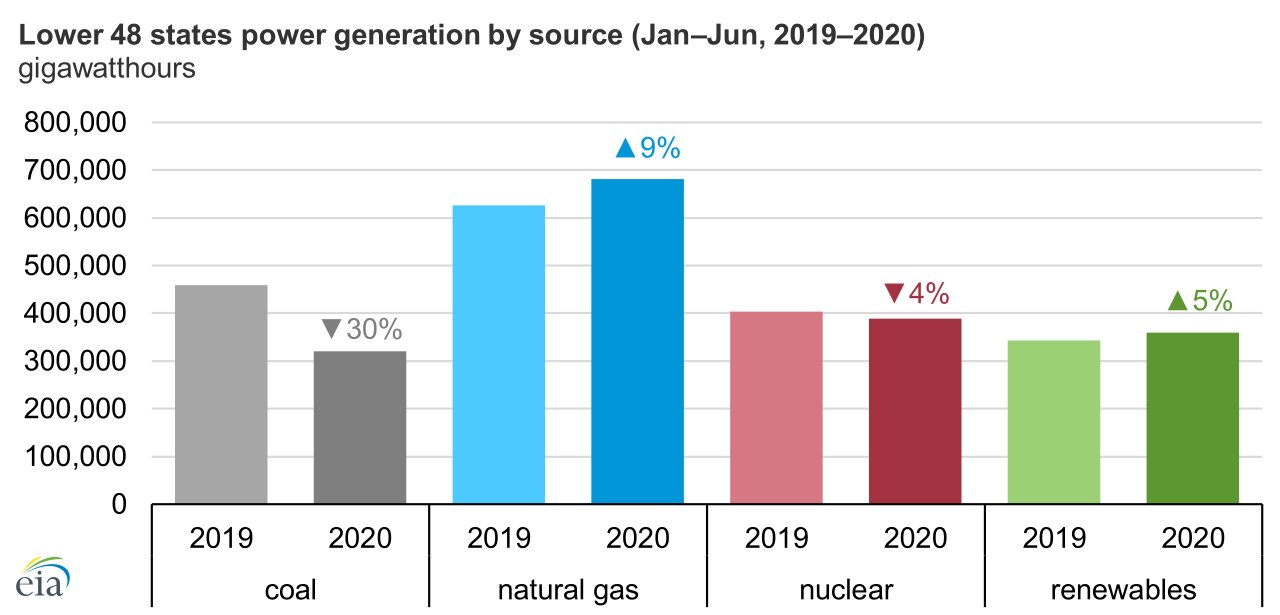

The following chart, from the U.S. Energy Information Administration, shows power generation by source for the Lower 48 states, comparing coal, natural gas, nuclear, and renewables, in terms of gigawatt hours. The chart shows the varying fortunes of each power source for the first half of 2019 and the first half of 2020 respectively.

Taking the information from the chart, we can see that natural gas fared the best in the opening six months of 2020, with coal suffering the biggest losses from the same time period in 2019. Coal saw a 30% decrease in gigawatt hours, with natural gas climbing 9%. In terms of gigawatt hours, this is a 55,000 GWh increase for natural gas, and a 138,000 GWh decrease for coal. Elsewhere, nuclear declined 4% and renewables grew by 5%.

The chart below, again courtesy of the EIA, shows power generation by source, for the Lower 48 states, between January 2019 and June 2020, in terms of gigawatt hours. As you can see, natural gas remained on top throughout this eighteen-month period.

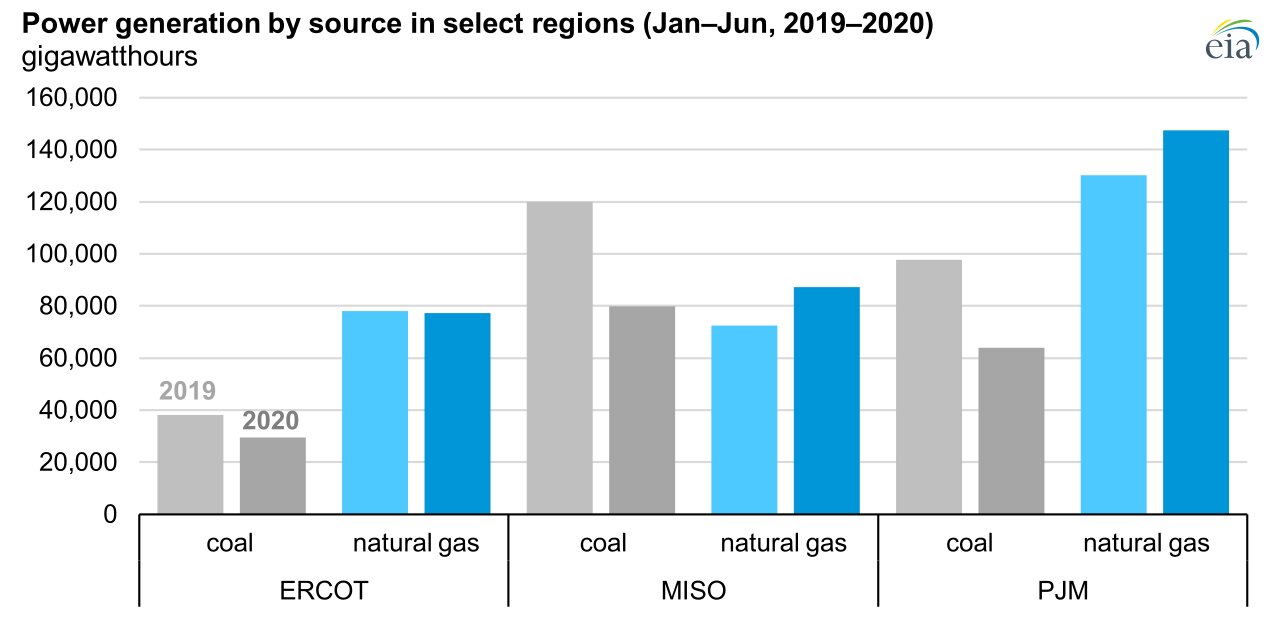

The downturn for coal and upswing for natural gas are, of course, connected, with historically low natural gas prices leading to many switches from coal generation to natural gas generation. The next chart, again from the EIA, contrasts the varying fortunes of coal and natural gas throughout select regions in terms of gigawatt hours, again comparing the first half of 2019 to the first half of 2020.

As evidenced by the chart, the switch from coal to natural gas was most prominent in the PJM Interconnection (an area stretching from New Jersey to Illinois) and the Midcontinent Independent System Operator (primarily covering areas in the Midwest). Combined, PJM and MISO account for roughly 35% of the total Lower 48 states’ electric power generation, hence the notable countrywide swing from coal to natural gas.

The other area covered in the chart is the Electric Reliability Council of Texas (ERCOT), which accounts for a smaller overall percentage of Lower 48 states’ electric power generation, at roughly 10%. As you can see from the chart, the decline in coal-fired generation was not offset by natural gas-fired generation, which also saw a slight decrease in GWh. Instead, this is where renewable energy generation, from sources like solar and wind, saw a big chunk of its year-on-year increase of 5%, which is highlighted in the first chart featured above.

Moving forward, natural gas-fired generation is likely to face stiff competition from renewable energy sources like solar and wind. As noted above, renewable energy generation also saw an increase from the first half of 2019 to the first half of 2020, the only generation source other than natural gas to do so. Somewhere in the region of 23,200 MW of new net solar and wind capacity has been added since 2018, and this trend looks set to continue into the future.

To go solar and support the further growth of renewable energy, reach out to YSG Solar today. YSG will identify the ideal solar project for your energy needs—residential, commercial, or community—and work to make it a reality. Send us an email, or call at 212.389.9215 to get started.

YSG Solar is a project development vehicle responsible for commoditizing energy infrastructure projects. We work with long-term owners and operators to provide clean energy assets with stable, predictable cash flows. YSG's market focus is distributed generation and utility-scale projects located within North America.

Sources: