Tax credits have stimulated development and markets for decades. In 2021, the ITC (investment tax credit) has been a key driver in the U.S renewable energy market, providing private sector checks and balances and collaboration among power generators, tax equity investors, syndicators, dealmakers and many others. The ITC is a non-refundable tax credit used to offset passive tax liability.

Entities who have passive active tax liability participating in the tax equity markets have traditionally been limited to a small pool, with institutions such as J.P. Morgan being major players in this segment. The ITC can be used to offset active tax liability if the entity utilizing the tax credit’s principal business is within the energy/electricity sectors, or related businesses, as the entity who is qualified to receive the ITC.

The active income vs passive income aspect has been a key component in limiting the quantity of tax equity investors in the market. Tax equity investors must acquire interests in the project company prior to the placed-in-service date to qualify for the tax credit. The taxpayer is considered to be the owner of the project at the time of the project reaching the placed-in-service date.

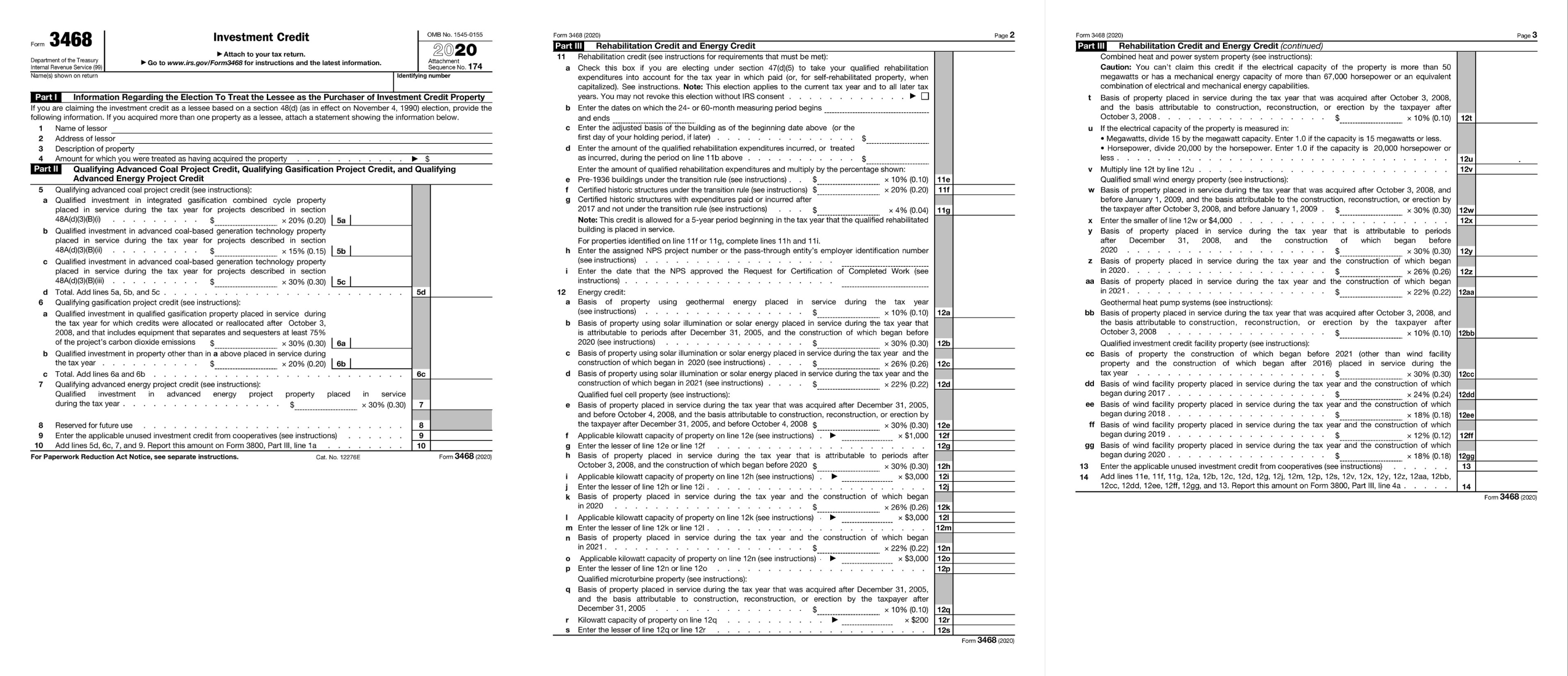

What is the federal tax credit/ITC (investment tax credit) form associated with solar?

The form used to receive the tax credit/ITC is Form 3468. You can download a copy of Form 3468 (from 2020) here.

Can the federal tax credit/ITC be recaptured?

Yes, it can. Stay tuned for more information related to the ITC recapture rules.

What does ‘placed-in-service’ mean and how does it relate to the ITC?

Section 1.167(a)-11(e)(1)(i) of the Income Tax Regulations provides, in part, that property is first placed in service when first placed in a condition or state of readiness and availability for a specifically designed function. It further provides that the provisions of § 1.46-3(d)(1)(ii) and (d)(2) generally apply for purposes of determining the date on which property is placed in service. In general, property is placed in service in the taxable year the property is placed in a condition or state of readiness and availability for a specifically designed function. See §§ 1.46-3(d)(1)(ii) and 1.167(a)-11(e)(1)(i). Placed in service is construed as having the same meaning for purposes of the investment tax credit under § 46 and depreciation under § 167. Section 1.46-3(d)(2) provides examples of when property is in a condition of readiness and availability. One of those examples is equipment that is acquired for a specifically assigned function and is operational but undergoing tests to eliminate any defects. See also Rev. Rul. 79-40, 1979-1 C.B. 13, where machinery and equipment were placed in service in the year critical tests (with appropriate materials) and operational tests were completed. Another example in § 1.46-3(d)(2) involved operational farm equipment acquired and placed in service in a taxable year even though it was not practical to use such equipment for its specifically designed function in the taxpayer’s business of farming until the following year.

Several Tax Court cases have addressed placed in service questions in the context of electric power plants. In Oglethorpe Power Corp. v. Commissioner, T.C. Memo. 1990-505, and Consumers Power Co. v. Commissioner, 89 T.C. 710 (1987), facilities can be deemed placed in service upon sustained power generation near rated capacity. However, if the facility operates on a regular basis but does not produce the projected output, it may still be considered placed in service. Sealy Power, Ltd v. Commissioner, 46 F.3d 382 (5th Cir. 1995), nonacq. 1995-2 C.B. 2. In the Action on Decision for Sealy Power, the Service stated that at a minimum, the property would have to have been in a state of readiness sufficient to produce electricity on a sustained and reliable basis in commercial quantities. AOD 1995-010. Finally, in Rev. Rul. 84-85, 1984-1 C.B. 10, a solid waste facility that was experiencing operational problems such that it was unable to operate at its rated capacity was nonetheless considered to have been placed in service since it was being operated on a regular basis and saleable steam was being produced. However, if a facility is merely operating on a test basis, it is not placed in service until it is available for service on a regular basis. Consumers Power v. Commissioner, 89 T.C. at 724.

The above-referenced cases and revenue rulings provide that the following are common factors to be considered in determining placed in service dates for power plants: (1) approval of required licenses and permits; (2) passage of control of the facility to taxpayer; (3) completion of critical tests; (4) commencement of daily or regular operations; and, (5) synchronization into a power grid for generating electricity to produce income.

The focus in determining a placed in service date is on ascertaining from the relevant facts and circumstances the date the unit begins supplying product in such a manner that it is routinely available and is consistent with the unit’s design. It is necessary to examine relevant factors occurring both before and after the claimed placed in service date so that the date can be verified. However, a facility does not have to achieve full design output to be placed in service as long as it is in the process of ramping up its production levels. Subject to exceptions that are beyond the taxpayer’s control, the Service has generally required actual operational use as a prerequisite for an asset to be deemed placed in service. See, e.g., SMC Corp. v. United States, 675 F.2d 113 (6th Cir. 1982).

Daily operation at full rated capacity is not necessary to establish that the projects are placed in service. As long as the projects are ready and available for use and producing commercial output on a regular basis, operating at full rated capacity is not necessary to establish that the projects are placed in service.

The Taxpayer Certainty and Disaster Relief Tax Act of 2020 (The Act)

The Act extended deadlines for certain energy properties and added a new credit for waste energy recovery property. Construction of waste energy recovery property must begin before 2024. The Act also provided special rules for offshore wind facilities and phasing out of certain investment credits.

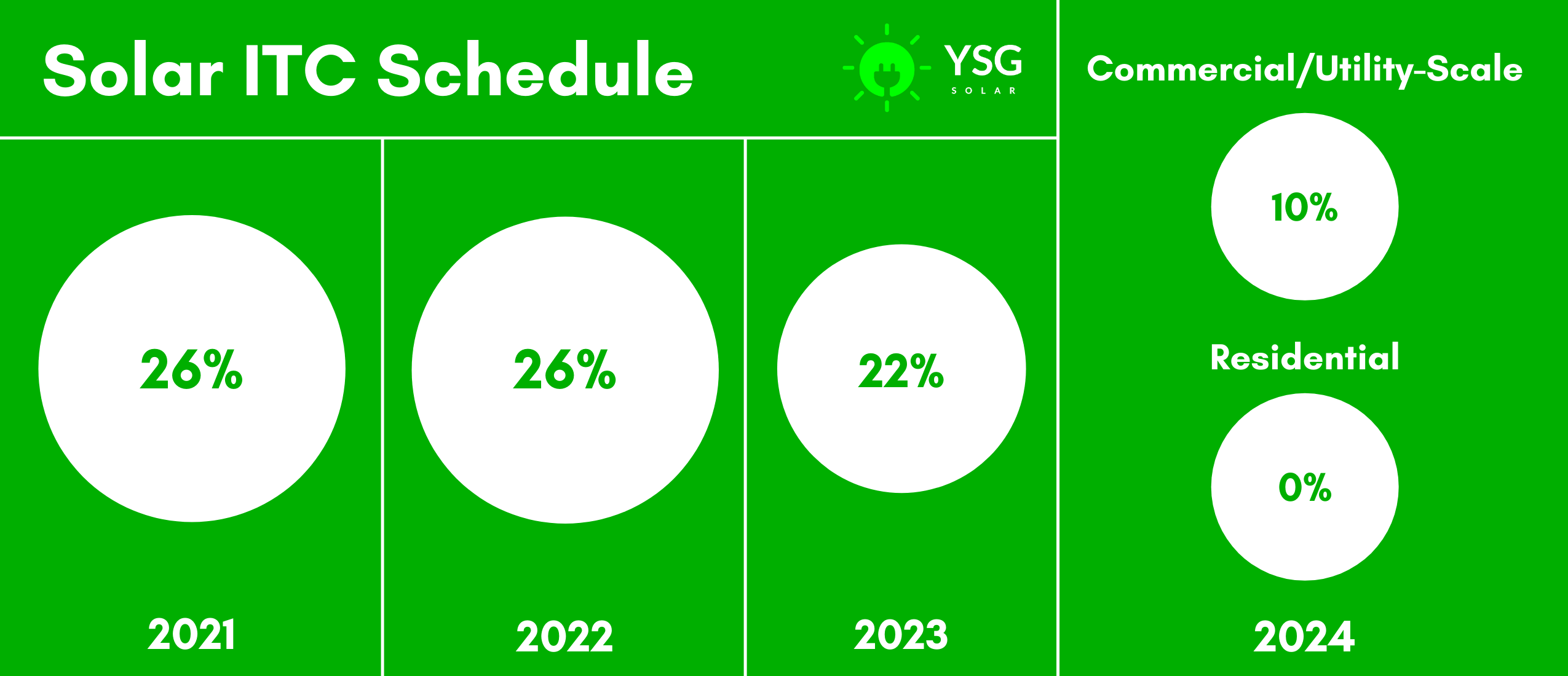

The credit for solar illumination and solar energy property is reduced to 26% for property the construction of which begins in 2020, 2021, or 2022.

Eligible Expenses

The ITC is calculated by multiplying the applicable tax credit percentage (10%–26%) by the “tax basis,” which is the amount invested in eligible property. Eligible property includes the following:

Solar PV panels, inverters, racking, balance-of-system equipment, and sales and use taxes on the equipment

Installation costs and indirect costs

Step-up transformers, circuit breakers, and surge arrestors

Energy storage devices (if charged by a renewable energy system more than 75% of the time)

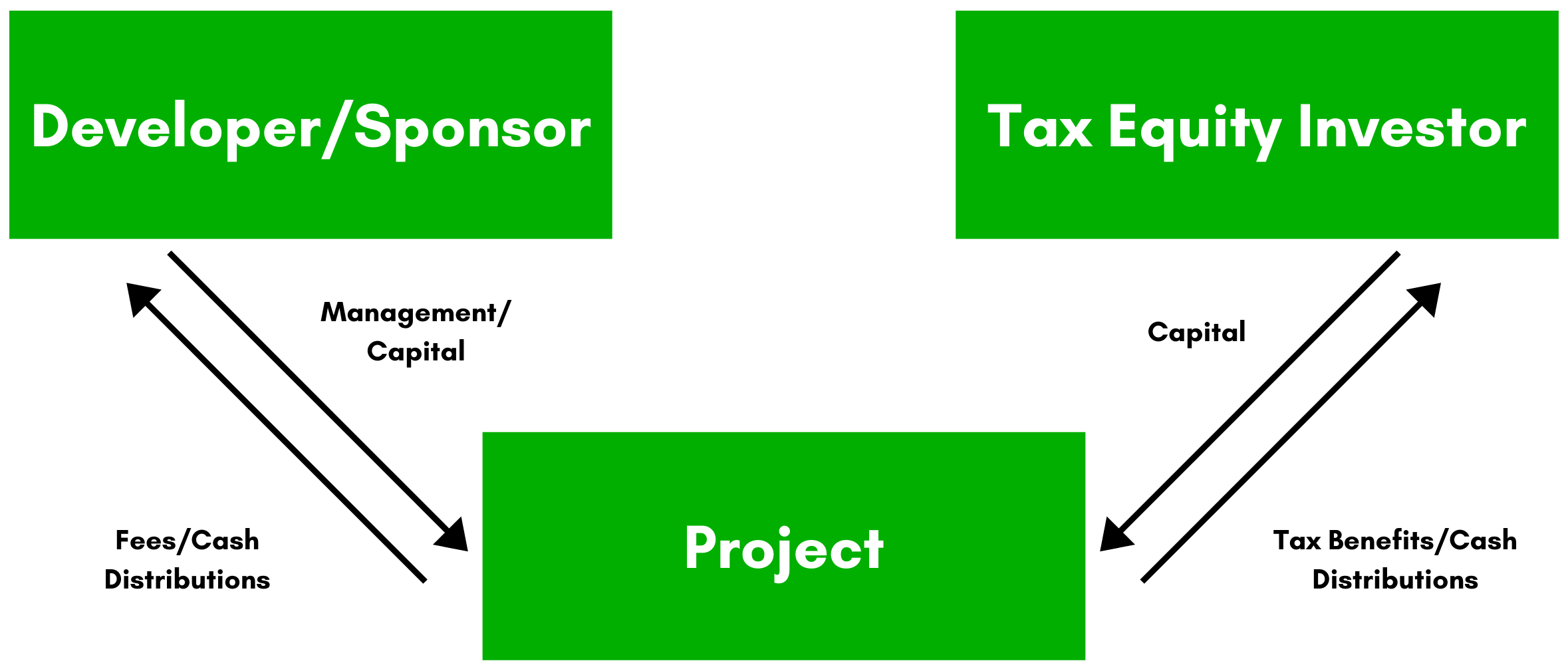

Tax Equity Financing

When a business developing a solar project does not have a large tax liability, tax equity financing may be an option to take full advantage of federal tax benefits. The business can partner with a tax equity investor who has a relatively large tax appetite and can make use of the tax benefits. There are the following three commonly used models, although the specific arrangements can be quite complicated:

Sale-Leasebacks: The developer sells the solar PV system to a tax equity investor who leases the system back to the developer.

Partnership Flips: The developer and investor form a partnership, and the economic returns “flip” from the investor to the developer after the investor makes use of the tax benefits and achieves target yields.

Inverted Leases: The developer leases the system to the investor, structuring the agreement in a way that allows the investor to use the tax benefits.

Unused Tax Credits Carryback and Carryforward Rules

Unused tax credits related to the commercial ITC may be carried back 1 year and forward 20 years. After 20 years, one half of any unused credit can be deducted, with the remaining amount expiring.

Financing eligible solar PV equipment purchased through debt financing qualifies for the ITC. However, individuals (including partnerships or limited liability companies), S corporations, and closely held C corporations financing a solar PV project by borrowing on a “nonrecourse basis” face additional rules that may delay claiming of the ITC. Borrowing on a nonrecourse basis means the borrower is not personally liable to repay the loan, and the lender primarily relies on the solar PV project as collateral. In general, the portion of the solar PV project paid through nonrecourse financing is not immediately included when calculating the ITC (although several exceptions exist); instead, in future tax years, the taxpayer can claim the ITC on the portion of the loan principal (but not the interest) as it is repaid.

YSG Solar is a project development company responsible for commoditizing energy infrastructure projects. We work with long-term owners and operators to provide clean energy assets with stable, predictable cash flows. YSG's market focus is distributed generation and utility-scale projects located within North America.

Sources/Helpful Links:

https://www.irs.gov/instructions/i3468#idm140475599379520

https://www.irs.gov/forms-pubs/about-form-3468

https://www.irs.gov/pub/irs-prior/f3468--2020.pdf

https://www.thetaxadviser.com/newsletters/2019/aug/solar-energy-credit.html