DISCLAIMER: YSG Solar are not tax professionals, or accountants, and thus cannot give professional taxation advice. This blog post should not be taken as such. Please consult your tax advisor before filing a return.

The federal investment tax credit (ITC) is one of the best solar incentives available to customers across the United States. The ITC has massively driven solar growth since its enactment over a decade ago. Now, with solar costs at record lows, and the ITC beginning to step down, there has never been a better time to go solar.

In this article, we will explain how to claim the solar investment tax credit. It’s usually a pretty straightforward process, but please note that we are a solar company, not tax professionals, so it is advisable to consult your tax advisor before filing a return. Despite the relative ease of claiming the solar ITC, tax codes can be complex, so it’s important to speak with a taxation professional if you have any doubts or questions.

Remember, in order to qualify for the solar ITC, you must own your solar panels. If you lease your panels, or have entered into a power purchase agreement (PPA), you are not eligible to claim the solar ITC. For a full explanation about the value of the solar investment tax credit, as well as details of eligibility requirements, please read our recent blog post.

How to Claim the Solar Investment Tax Credit

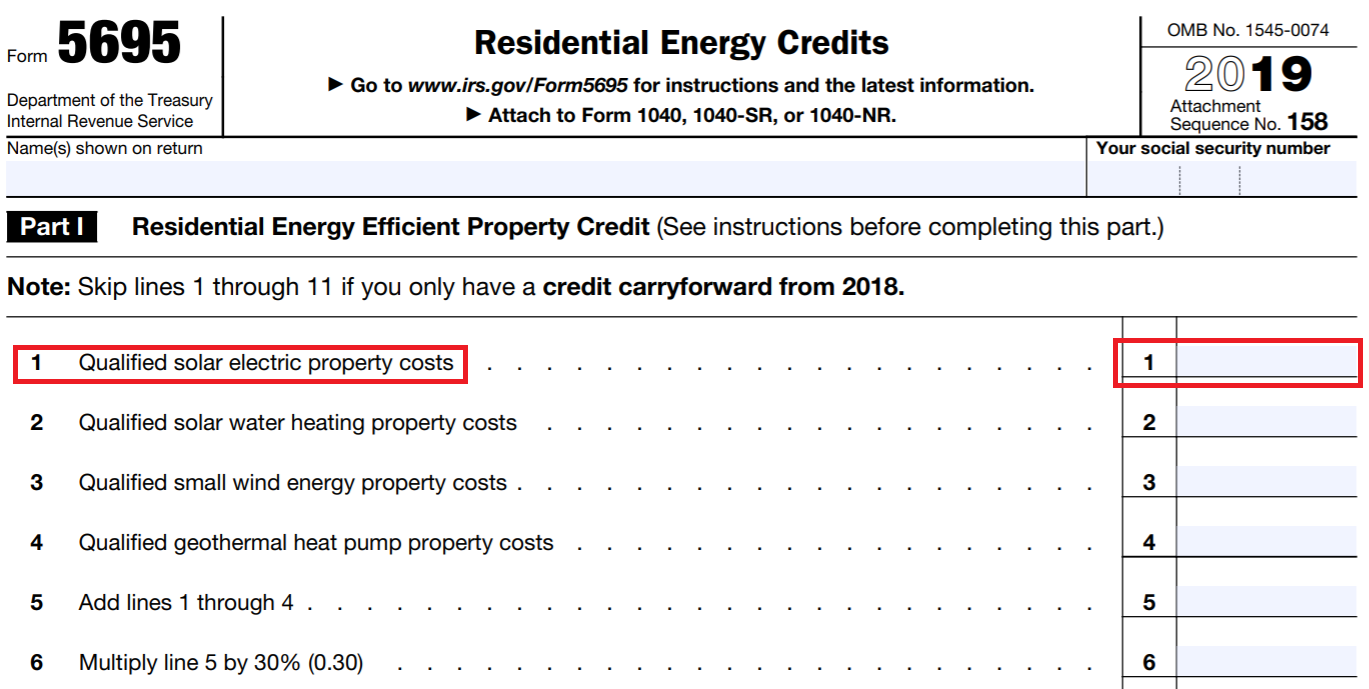

Claiming the solar ITC is a relatively straightforward process. When you are completing your federal tax return, you must complete and file Form 5695, entitled "Residential Energy Credits", alongside the rest of your tax paperwork. Using this form, you will be able to calculate the value of your tax credit and enter this calculated value on Form 1040. If your tax liability is not large enough to take advantage of the full value of the solar ITC, then you can roll the tax credit over to the following year—as long as the ITC is still in effect. With the ITC stepping down to 22% in 2021, and then to 10% for commercial/utility-scale solar only from 2022 onwards, time is running out to take advantage of this fantastic incentive.

Completing Form 5695 to Claim the Federal Investment Tax Credit

On Form 5695, go to the line “Qualified solar electric property costs”. On the 2019 edition of the form, linked throughout this article, you will find “Qualified solar electric property costs” on line 1. In the box beside this, you will enter the total gross cost of your solar energy system after any cash rebates.

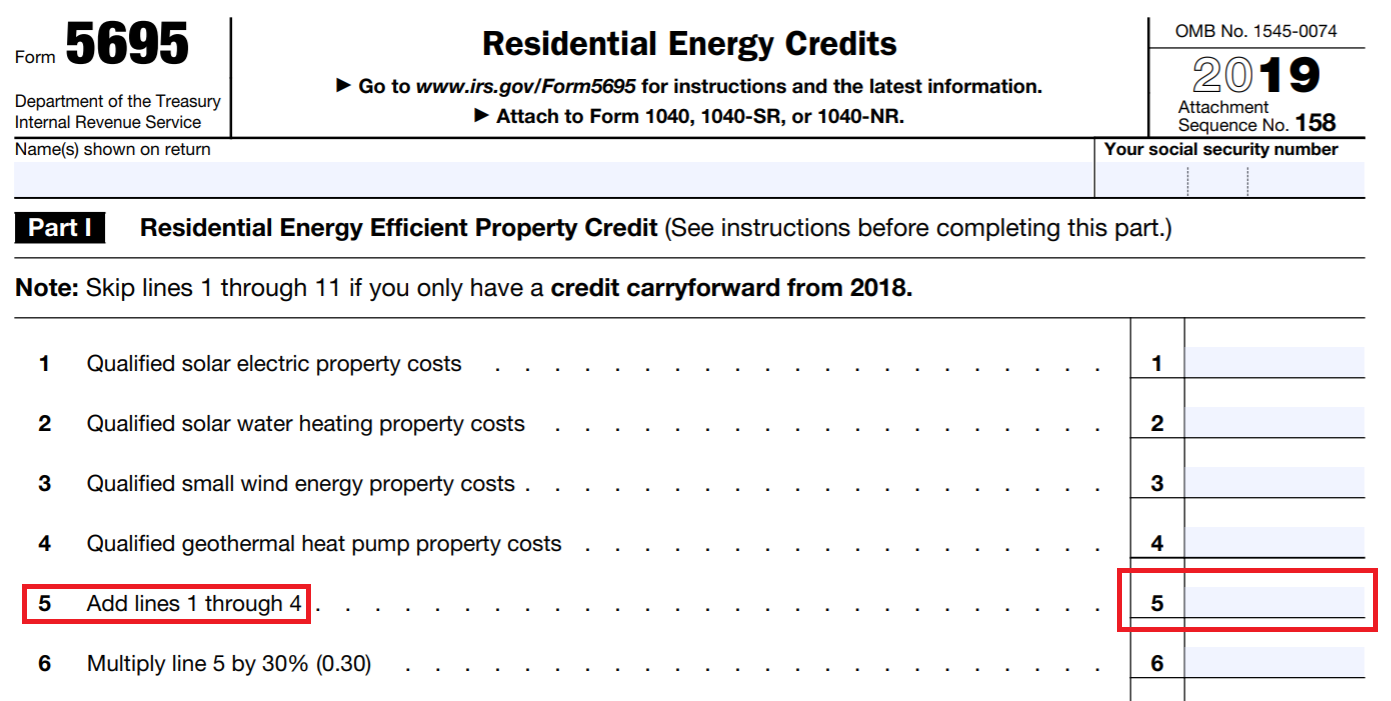

Moving down the form, you will come to line 5, which states, “Add lines 1 through 4”. Assuming you have left lines 2 - 4 blank, you will enter the same figure as you did in line 1. If you have entered additional figures for lines 2 - 4, add up all figures from lines 1 - 4 as advised and enter your total in the box on line 5.

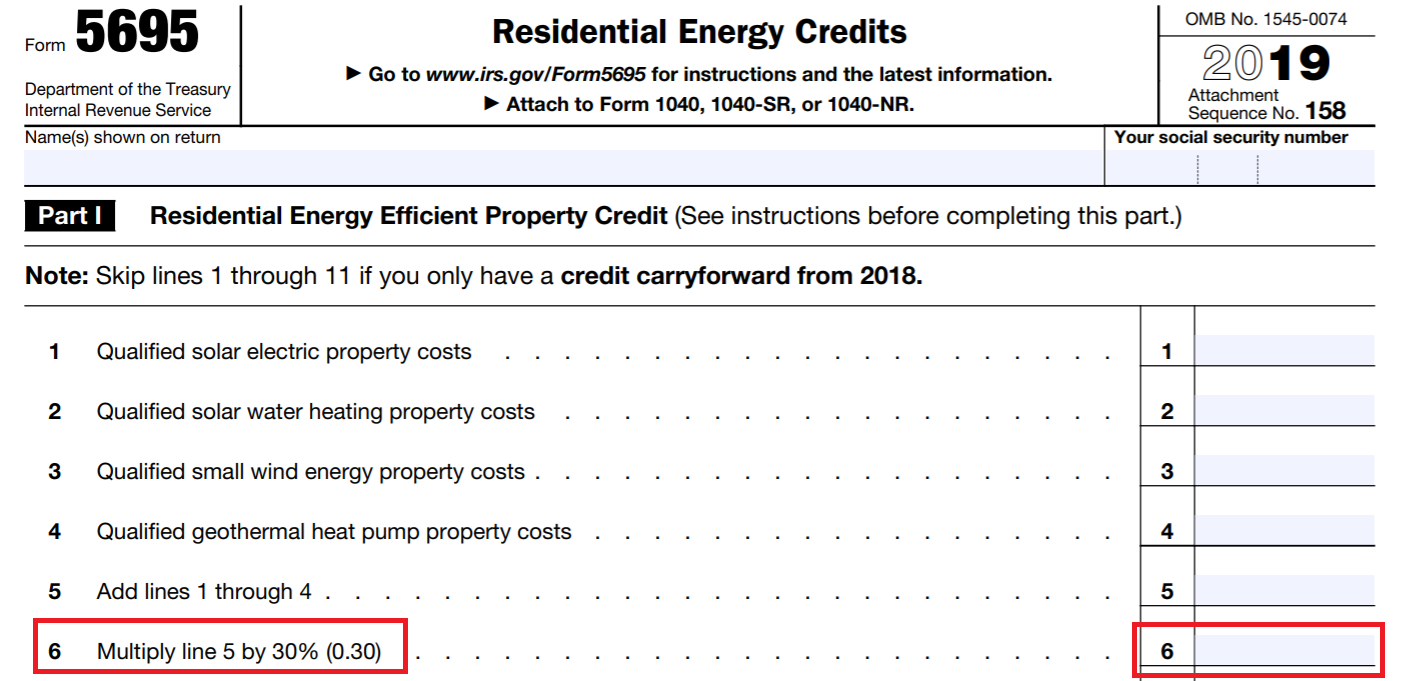

For the next step, on line 6, you will calculate the value of your tax credit. If filling out the 2019 form, as pictured, you would multiply your total from line 5 by 30% (0.30). However, when filling out the 2020 form, you will multiply your total by 26% (0.26). Please note that the sample images in this article are from the 2019 edition of the form, and they show the full 30% ITC which was still available. As noted, the ITC has since stepped down to 26% for 2020.

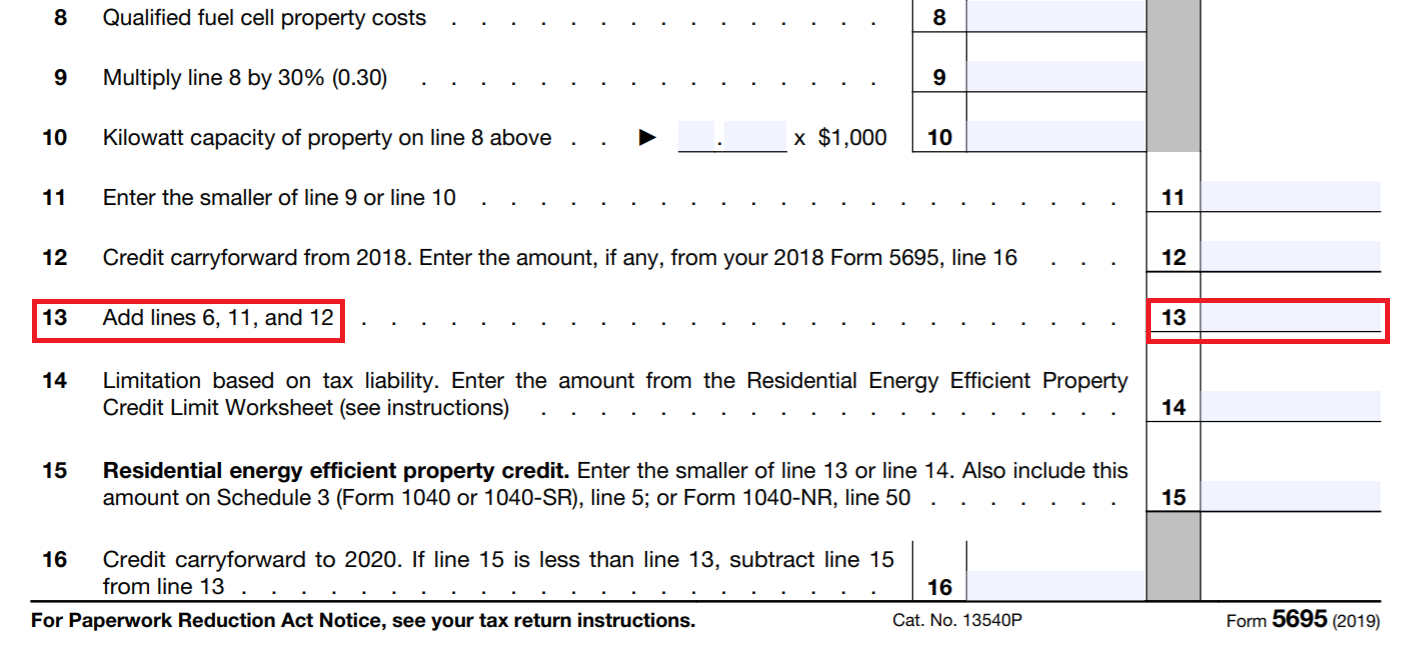

Moving further down the form, you will come to line 13, “Add lines 6, 11, and 12”. Assuming that you have not entered figures relating to fuel cell tax credits, or carried forward credits from the previous year, then you will enter the value from line 6 again on line 13.

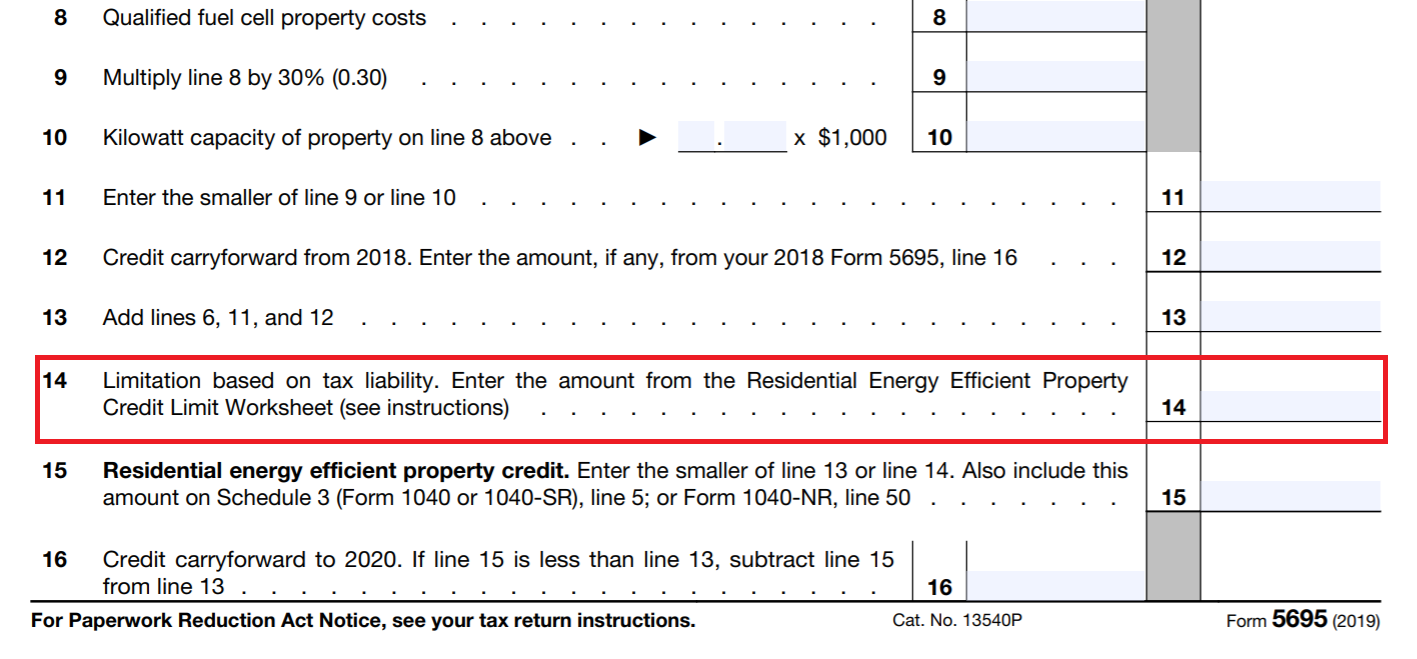

Using the "Residential Energy Efficient Property Credit Limit Worksheet", found on Page 4 of the 2019 Instructions for Form 5695, you will be able to calculate the limit on tax credits you can claim based on your federal tax liability. To complete this worksheet, you may need information regarding other claimable tax credits at hand.

Taking the result of the worksheet, you will return to Form 5695 and enter this result on line 14.

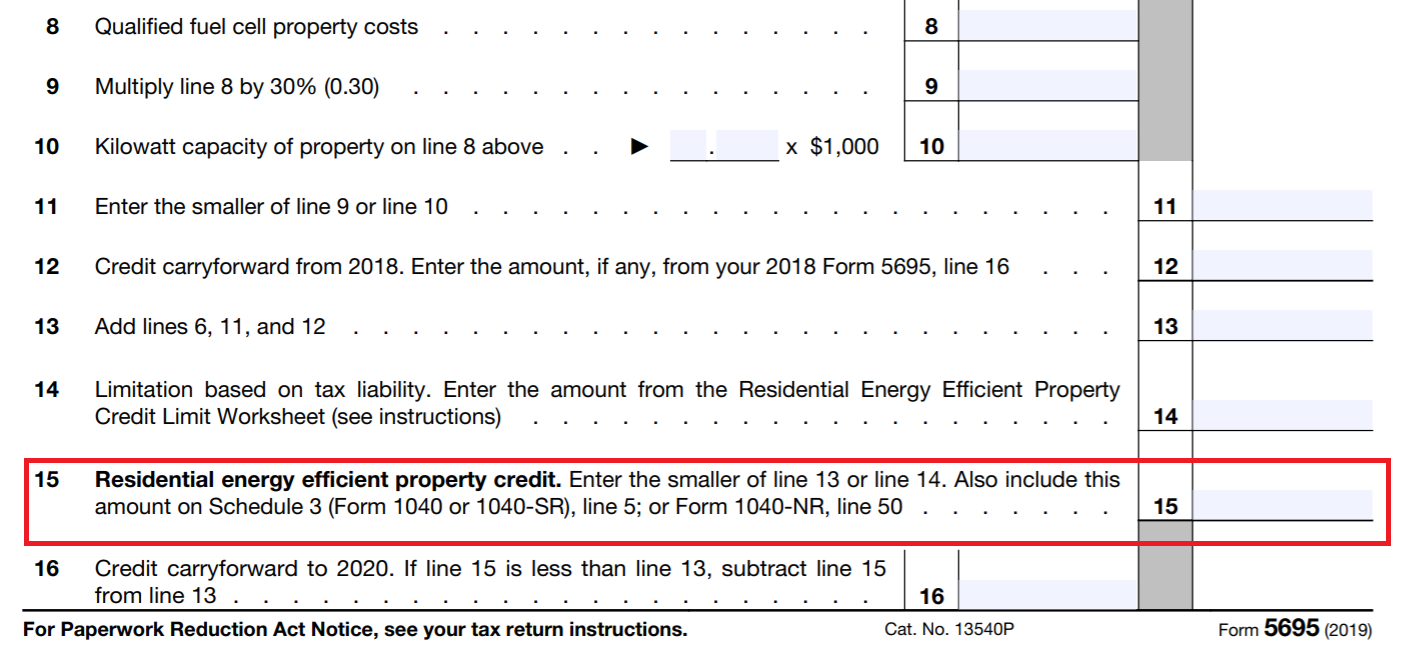

Next, compare lines 13 and 14. Whichever number is smaller, take this and enter it on line 15.

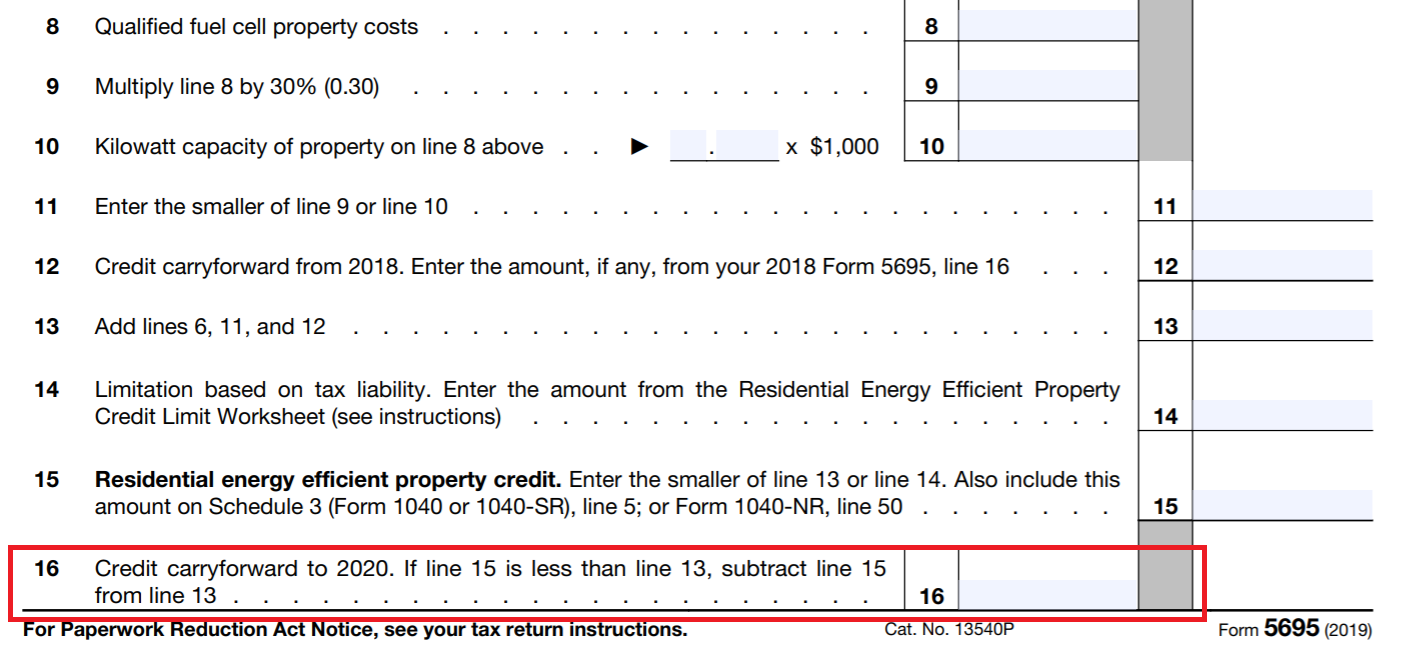

If the figure on line 15 is smaller than the figure on line 13, subtract line 15 from line 13 and enter the resulting figure on line 16. This is the amount of the credit you will be able to roll over to next year’s federal tax return.

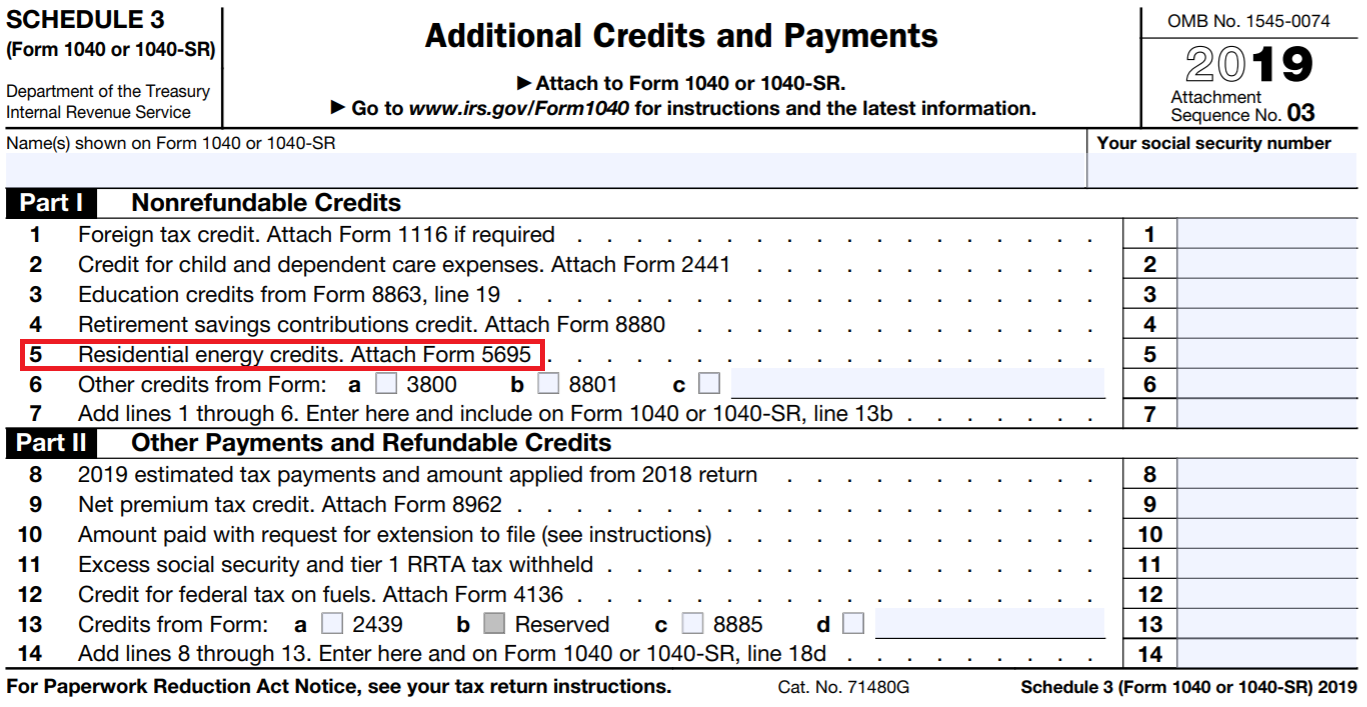

Taking the figure from line 15 on Form 5695, you will enter this number on Form 1040 in the “residential energy credits” section. On the 2019 edition of the form, this is found on line 5 in the section entitled “Additional Credits and Payments”.

Make sure that you submit the completed Form 5695 alongside your other paperwork when filing your federal tax return.

You can view Form 5695 at this link. This guide is merely an outline of the key steps and does not cover every single aspect of filing. If you require further clarification about filing Form 5695 and claiming your solar tax credit, we advise that you consult a taxation professional.

If you would like more information about the federal solar investment tax credit, or you are interested in pursuing a solar project for your home or business, please reach out to YSG Solar today. Send us an email or call at 212.389.9215 to get started, or just learn more.

YSG Solar is a project development vehicle responsible for commoditizing energy infrastructure projects. We work with long-term owners and operators to provide clean energy assets with stable, predictable cash flows. YSG's market focus is distributed generation and utility-scale projects located within North America.

DISCLAIMER: YSG Solar are not tax professionals, or accountants, and thus cannot give professional taxation advice. This blog post should not be taken as such. Please consult your tax advisor before filing a return.

Sources:

https://solartechonline.com/blog/california-solar-tax-credit/

https://news.energysage.com/how-do-i-claim-the-solar-tax-credit/

https://turbotax.intuit.com/tax-tips/going-green/federal-tax-credit-for-solar-energy/L7s9ZiB4D

https://www.irs.gov/pub/irs-pdf/f5695.pdf